SMSF Admin Services

Ad-hoc Outsourced SMSF admin services for firms who need job-by-job SMSF admin compliance outsourcing

1. What SMSF tasks can we do

| Tax Compliance | Administration | |

|---|---|---|

| ✓ Tax Return | ✓ Trustee minutes | |

| ✓ Financial Position | ✓ Trust deeds | |

| ✓ Profit and Loss | ✓ TBAR | |

| ✓ Member Statements | ✓ Death Benefits | |

| ✓ Investment reports | ✓ SMSF Wind up |

2. What software do we work with

- Class

- BGL

3. How we complete your work

We use your workpapers:

As part of the onboarding process, we request you to send us your preferred SMSF workpapers. We also request you give us a rundown of what your SMSF auditor expects to receive and the level of detail required in our preparation.

Receiving our queries:

We will draft all queries on that workpaper (unless we have other instructions) and make sure to reference and link each item to the corresponding tab for quick resolution by yourself where applicable.

Finalising the job:

Once we have received the queries, we proceed to finalise the job and prepare the financials and tax returns in the way you want them. We will seek guidance from you to prepare the finalised document file in the exact format you require.

4. How to communicate with the team

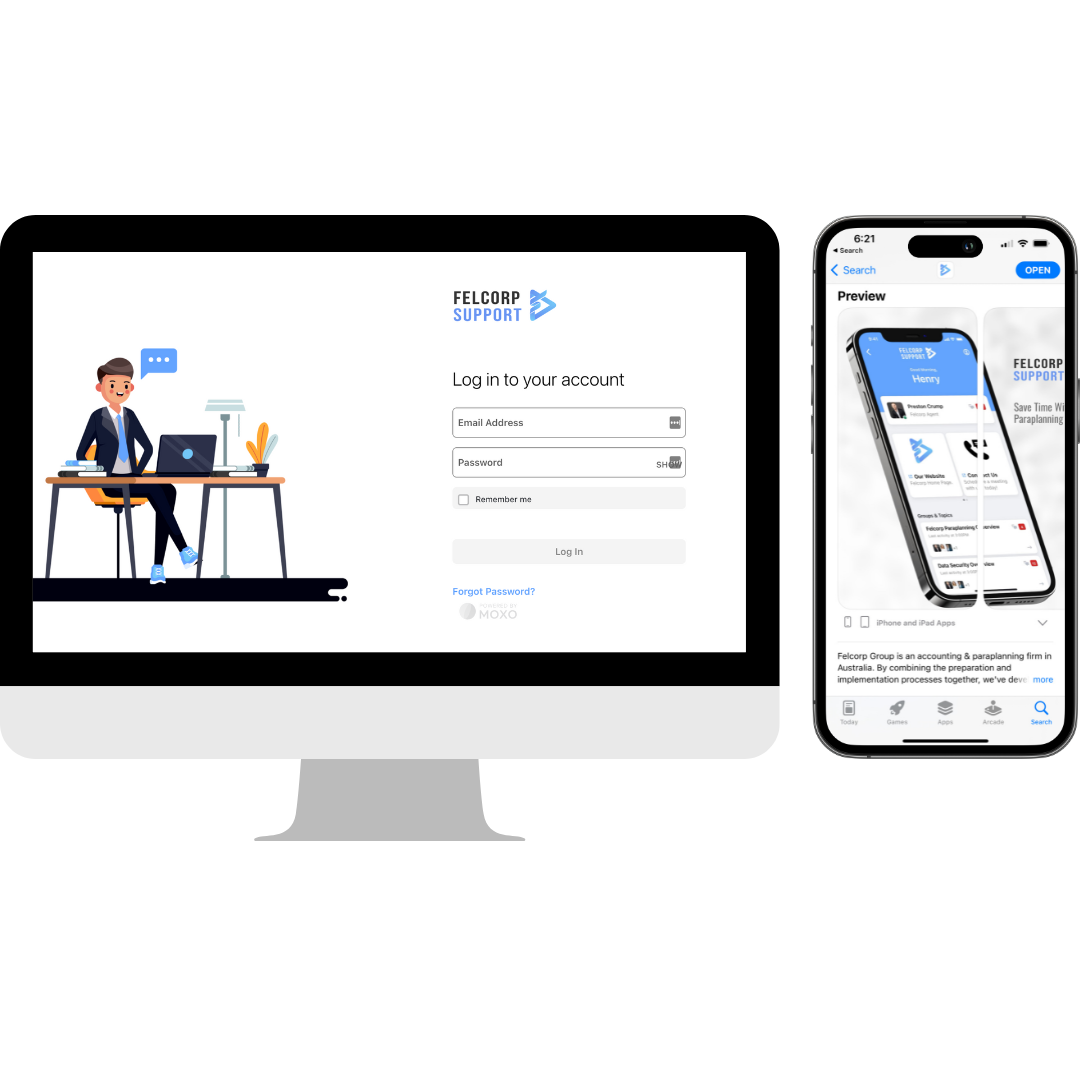

Using the Felcorp App for daily communication:

For everyday communication, we recommend utilising the Felcorp Support app as our team leaders and senior managers are included in the workflow discussions to ensure timelines and quality controls are adhered to.

Using email as your preferred method:

If you wish to use email to communicate to our team, please do not attach workpapers of confidential client info to the email body. Please upload the documents into the Felcorp Support app or alternatively, invite our team into your file storage system.

5. What our fees are

Ad-hoc

$440/ea

Price includes GST. Fees are in AUD.

Volume discounts available.

Ideal for most practices that have fewer than 150 SMSFs

Full Time SMSF Accountant

$4,840/mo

Price includes GST. Fees are in AUD.

Volume discounts available.

Ideal for SMSF specialist practices or larger practices with 200+ SMSFs to complete each year.

Let us help you

Get started with personalised support. We'll help create a tailored offshore staffing plan for your business.